Commercial Finance Northern Ireland

Commercial finance is often a key factor in the success of your business. It can help you grow, innovate and bridge cashflow gaps. In this article, we'll explain what commercial finance is and how it can benefit your business in Northern Ireland. What is commercial finance? Commercial finance is a type of lending that helps businesses grow, innovate or bridge a cashflow gap. It's not to be confused with asset finance, which is generally used to fund the purchase of equipment or machinery required by your business. Commercial finance can help you take advantage of opportunities that arise during growth phases and support you in overcoming challenges you may experience on the way: Purchasing property or land to expand your

Funding Working Capital

Funding Working Capital is a challenge for many SMEs in Northern Ireland. Johnston Financial Solutions can arrange finance to support your working capital and trade finance needs. These solutions include releasing value from your assets, sales, and stock. Please speak to our team today to see how we can help your business access better solutions to commercial finance. Control over your cash flow is critical to every business's success. Whether you are looking to fund growth, reduce debt, or enhance your balance sheet, optimisation of working capital is vital. Many business owners can make better strategic decisions if they can finance the working capital needed to be innovative or push for growth. Some businesses fail to realise the value within

Improved Access to Small Business Finance in Northern Ireland

Susan Nightingale, Senior Manager British Business Bank Northern Ireland, discusses the improved access to Small Business finance and the evolving funding landscape for Small business owners in Northern Ireland. Watch the video and learn more about the role of British Business Bank in improving access to Commercial Finance for Small Business in Northern Ireland. The Evolving Funding Landscape in Northern Ireland “If I had to pick one word to describe, the access to finance landscape at the moment, I would say evolving. We've seen a shift in the appetite to take on finance. And we've seen a positive shift as well in terms of understanding and awareness of the options that are out there.” says Susan Nightingale Senior Manager at

Commercial Mortgage

A Commercial Mortgage is a type of borrowing related to financing commercial property. Commercial mortgages can be arranged for financing the purchase or re-mortgaging of a property that is primarily for commercial or business use. A commercial mortgage can be arranged for a trading business to trade from, or alternatively as a form of investment such as a commercial buy to let mortgage. Learn more about Commercial Property Finance You may be considering purchasing a commercial property, for example, offices, retail, or warehouses. Or perhaps you want to check the suitability of a commercial mortgage for the purchase of a semi-commercial property, for example, a shop with residential accommodation above, or a house with a commercial unit attached. In this

Asset Financing

Asset Financing is a type of borrowing related to the assets of a company. In asset financing, the company uses its existing inventory, accounts receivable, or short-term investments to secure short-term financing. Book a meeting with Mark to find out about how asset finance might work for your business What is Asset Financing? There are two ways to finance assets: Companies use financing to secure the use of assets, including equipment, machinery, and other capital assets. A company will be entitled to full use of the asset over a set period of time and will make regular payments to the lender for the use of the asset. The second variation of asset financing is used when a company wants

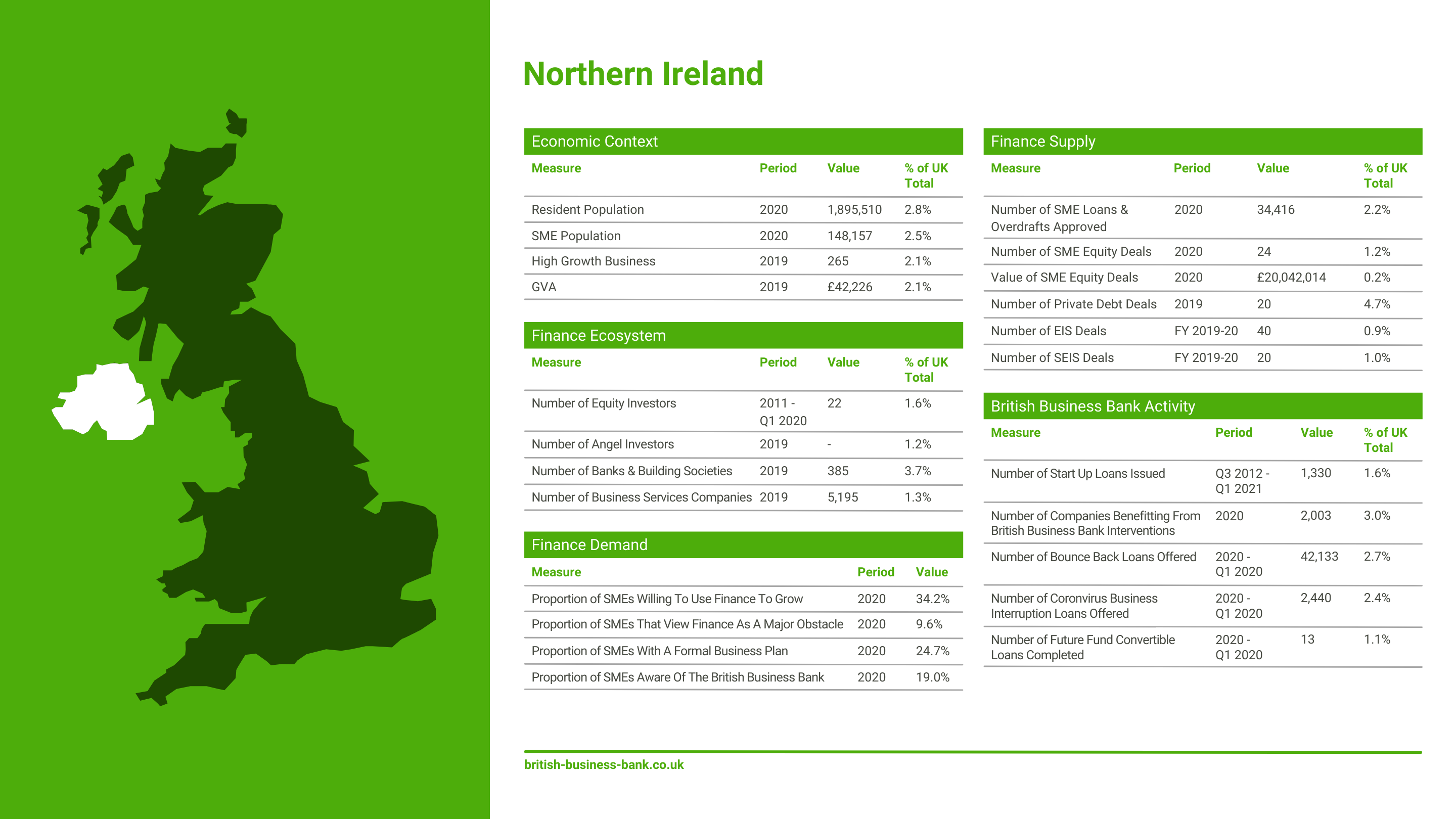

Improving SME Access to Commercial Finance with the British Business Bank

Improving SME access to Commercial Finance in Northern Ireland is a core objective of the British Business Bank ( BBB). Research carried out by the BBB reports record levels of smaller businesses seeking external financial support in 2020, with further significant demand throughout 2021 expected to be confirmed in the forthcoming report. The British Business Bank’s mission is to make finance markets work better so smaller businesses across the UK can prosper and grow. Their Small Business Finance Markets Report and Regional Tracker Reports share how access to funding in Northern Ireland has changed. There has been a surge in the use of government-backed loans and grants while bank overdraft applications flatline in 2020/2021. At this crucial time for