Improving SME access to Commercial Finance in Northern Ireland is a core objective of the British Business Bank ( BBB). Research carried out by the BBB reports record levels of smaller businesses seeking external financial support in 2020, with further significant demand throughout 2021 expected to be confirmed in the forthcoming report. The British Business Bank’s mission is to make finance markets work better so smaller businesses across the UK can prosper and grow. Their Small Business Finance Markets Report and Regional Tracker Reports share how access to funding in Northern Ireland has changed. There has been a surge in the use of government-backed loans and grants while bank overdraft applications flatline in 2020/2021. At this crucial time for the economy, it is crucially important that we continue to educate business owners of the changing financial ecosystem and the supports available to aid recovery, growth and innovation.

What is the British Business Bank?

British Business Bank plc (BBB) is a state-owned economic development bank established by the UK Government. It aims to increase the supply of credit to small and medium enterprises (SMEs) and provide business advisory services. The British BusinessBank aims to drive sustainable growth and prosperity across the UK and transition to a net-zero economy by supporting small business access to finance. Their objectives are to:

- Increase the supply of finance available to smaller businesses where markets don’t work well.

- Help create a more diverse finance market for smaller companies, with a greater choice of options and providers.

- Identify and help reduce imbalances in access to finance for smaller businesses across the UK.

- Encourage and enable SMEs to seek the finance best suited to their needs.

- Be the centre of expertise on smaller business finance in the UK, providing advice and support to Government.

- Achieve our other objectives whilst managing taxpayer resources efficiently within a robust risk management framework.

- Support the UK’s transition to a net-zero economy.

The British Business Bank is 100% Government-owned but independently managed. They do not lend to small businesses or invest directly. Instead, BBB works with over 130 partners, including banks, leasing companies, venture capital funds, and web-based platforms to improve SME Access to Commercial Finance

How do the British Business Bank Improve SME access to Commercial Finance?

BBB creates the opportunity for smaller firms to invest and grow, creating additional jobs and economic activity. Businesses apply for finance through partners who can lend and invest more, especially to younger and faster-growing companies because these lenders work with the BBB. The lending facilities, including those offered under the Recovery Loan Scheme, are designed to benefit smaller businesses that are start-ups, high growth, or simply viable but underfunded.

British Business Bank Small Business Finance Markets Report 2020/2021.

Small and Medium size businesses are the foundations of the economy in the UK and improving access to commercial finance is critical if we are to recover prosper and grow. The BBBs Small Business Finance Markets Report shares how access to funding has changed in Northern Ireland and across the UK for small and medium-size businesses as they coped with the challenges of Covid 19 and plan for recovery.

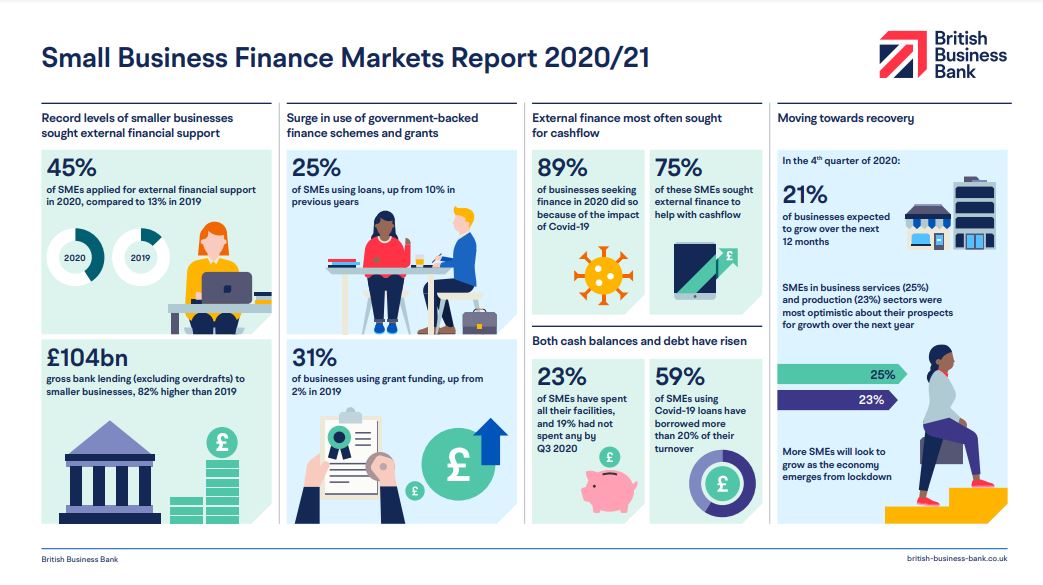

Record levels of smaller businesses sought external financial support in 2020, finds British Business Bank research with further significant demand expected in 2021 in the forthcoming report.

The research reports £104 billion gross bank lending to smaller businesses which is 82% higher than in 2019. Some 45% of Smaller companies applied for external financial support in 2020, which increased 19% from the previous year. Lending was supported by government-backed finance schemes and grants, which helped SMEs cope with Covid 19. The vast majority of SMEs sought external finance to help with pressures on cash flow.

The research finds optimism about recovery and growth amongst SMEs, with those in businesses services and production most optimistic about their prospects for growth over 2021/2022

The British Business Bank Regions and Nations Tracker

The Regions and Nations Tracker explores the geographic patterns seen in UK small business finance. The first annual tracker complements the Small Business Finance Markets report with additional regional analysis as summarised in the Access to Finance Spotlight: Northern Ireland findings.

Key Findings

External finance is an essential tool for businesses, but it is not evenly spread across the UK.

The largest four regions within the UK, London, the South East, the East of England and the North West, host 55% of the business population but take in 86% of equity investment. These areas also outperform on private debt, attracting 69% of the investment. Core debt products are the most used form of external finance in all regions of the UK. Debt products remain the most widely used, although overdrafts and credit cards have typically been more popular than bank loans. This pattern of core debt as the most commonly used finance category holds for all parts of the UK though there is some variation in usage rates for some specific product types. Northern Ireland is at the top of the range for all four most common finance types; overdrafts, credit cards and bank loans.

Gaps in finance lead to wasted economic potential, so we need to understand the geographic factors.

Although London, the South East, the East of England and the North West outperform the rest of the UK in attracting necessary forms of growth finance, their share of high growth businesses is unremarkable. 55% of high growth businesses were in these four regions between 2018 and 2019, a percentage that exactly matches the proportion of the general business population to be found.

In Northern Ireland, demand for finance was strong across all development stages, with 59% saying demand exceeded supply. A majority of respondents in NI felt SMEs would require additional finance due to the Covid-19 pandemic during the next 12-18 months, especially debt finance (85%) and early-stage equity (72%). These findings were similar to the UK overall.

“Demand for finance is always good. NI is reasonably well served at very early stages with NI government-sponsored funds. This means that compared to other areas in Britain, we are better at an earlier stage.” Financial advice respondent, N. Ireland

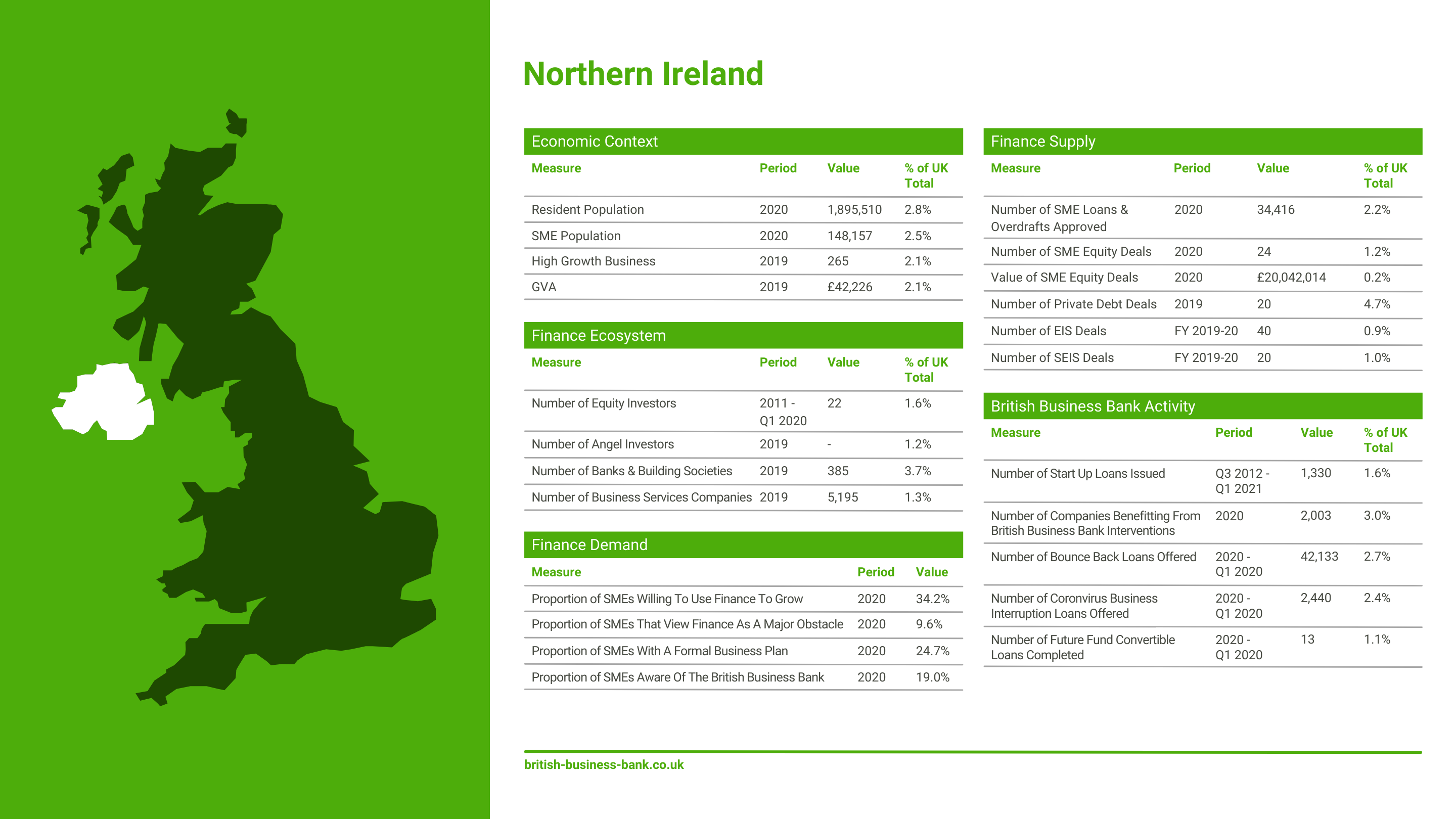

In Northern Ireland, there is an increasing appetite for competitive commercial finance with 34.2% of SMEs willing to use finance to grow their business in 2020. A clearer picture of the finance ecosystem in Northern Ireland is presented in the summary of the Regions and Tracker Report Data for Northern Ireland below.

Distance matters, even in a business world that has embraced remote working

Distance matters in equity finance. In 82% of equity investment stakes, the investor has an office within two hours travel time of the company they are backing. In 61% of instances, the proximity is even closer, and the two parties can travel between their premises in one hour or less. Increased remote working in 2020 does not appear to have affected these distance patterns in equity investment.

Local investors are more important in Northern Ireland than other regions, some 59% of investor pairings involving companies from within Northern Ireland.

The finance ecosystem in Northern Ireland is beginning to diversify with companies weighing up the benefits and challenges of equity finance. However, two-thirds (64%) of NI respondents also identified gaps in the supply of early-stage equity finance, which echoes the sentiments of respondents across the UK as a whole.

Rurality matters, too, with rural businesses seemingly more pressed into injecting personal funds.

In each nation of the UK, rural firms are essential. Northern Ireland has a much higher proportion of businesses based in rural locations, with 58% of registered businesses in rural areas, while the proportions sit at 23 % in England and Scotland and 45% in Wales. Across the UK, 39% of rural firms were currently using a form of external finance in 2020 compared to just 36% of urban businesses.

Despite higher external finance use, a more significant share of rural businesses injected personal funds in 2020. 37% of rural-based business owners had injected private funds into their business in the last 12 months compared to 32% of their urban counterparts.

Johnston Financial Solutions ( JFS) continues to help rural Northern Ireland access commercial finance to grow their businesses. JFS are committed to reducing the disparity between urban and rural commercial finance provision by publishing case studies highlighting rural client success stories and engaging with rural business networks to share our expertise and improve access to a diverse range of alternative funders. If you have any questions, don’t hesitate to get in touch with Mark and the team today.

Regions and Tracker Report Data for Northern Ireland

Below are the Regions and Tracker report data to show the finance ecosystem within Northern Ireland and regional access to commercial finance. This data highlights how Northern Ireland businesses have accessed finance within the broader UK finance market.

The Finance Eco-System in Northern Ireland

Respondents in NI were particularly optimistic about the ecosystem for SMEs consolidating success, with 74% saying it was adequate. Opinion was more split on the adequacy of the ecosystem for start-ups or SMEs surviving. At the same time, NI respondents seemed more negative than the UK average when scale-ups (55% inadequate NI versus 42% inadequate UK).

“It’s the next stage where there is a lack of proper assistance for businesses. Those that have got past the first two years, and are deemed to be existing businesses…[that’s] where the challenge is.”

Financial advice respondent, N.Ireland

As an Independent credit broker Johnston Financial Solutions can support SMEs in Northern Ireland navigating the commercial finance ecosystem by providing access to a diverse panel of lenders. The alternative finance market comprises challenger banks, peer to peer lenders and private funds. These lenders are more than willing to engage with businesses who have been trading for two years and are ready to take on finance to facilitate growth because they can receive a healthy return.

Demand for finance

In Northern Ireland, respondents thought demand for finance in the nation was strong across all development stages, with 59% saying demand exceeded supply. The top three barriers to SMEs’ demand for finance identified by respondents in NI were lack of awareness of finance options available (72%), access to the supply of finance (57%) and aversion to taking on finance (49%). Fewer than one in five (17%) respondents identified EU Exit as a barrier to SMEs’ demand for finance, in line with the UK average.

In response to the research findings, Johnston Finacial Solutions are actively addressing respondents concerns that there is a lack of awareness of finance options available to Northern Ireland businesses. We are increasing the publication of information across our digital platforms and social media accounts in order to increase awareness of the diverse range of credit brokerage available in Northern Ireland. Follow JFS on LinkedIn for updates

Supply of Finance in Northern Ireland

Despite most respondents in NI expecting SMEs to require additional finance, 83% agreed that there were gaps in the supply of finance for SMEs in Northern Ireland, whatever their stage of development.

“Mainstream banks will continue to shy away from doing too much business with smaller SMEs.”

Finance provision respondent, N.Ireland

At Johnston Financial Solutions, we believe there is a misconception about the supply of finance in Northern Ireland. Our experience is that lenders are willing to extend credit to SMEs. However, practical business administration and adequate support in business planning can create a barrier. Our SME clients have vastly improved the finance available to their business by taking action through outsourcing bookkeeping and finance functions successfully.

Improving SME access to Commercial Finance with Susan Nightingale British Business Bank

Mark Johnston is delighted to be meeting with Susan Nightingale, Network Manager for British Business Bank in Northern Ireland. Susan is an experienced financial professional with an in-depth knowledge of the SME funding environment across debt and equity markets. The private event will be held at the newly opened AMP Incubator in early March. Shortly afterwards, a video of the discussions will be shared with Marks connections across social media.

Enterprise Week 2022 Derry City and Strabane District Council Area

Improving access to commercial finance in Northern Ireland means that we need to reach out to more sole traders and SMEs across the region. Mark Johnston will be attending an event supporting Enterprise Week 2022 in Derry City and Strabane District Council. The council website will be updated with event details. The finance event is held at the White Horse Hotel Campsie on Friday, March 11th 10- 12 pm. We invite you to come along to the event and meet Mark. We will be happy to answer any questions you have about business loans.

Improving Access to Commercial Finance in Northern Ireland

As an independent credit broker, we are committed to improving access to competitive commercial finance for SMEs across Northern Ireland JFS is improving access to commercial finance by sharing our knowledge of the alternative finance market. Following the introduction of the government-guaranteed loan schemes, Johnston Financial Solutions have continued to raise awareness of the Recovery Loan Scheme products for Northern Ireland Businesses. Book a meeting to chat about access to commercial finance

Improving Access to Commercial Finance in Northern Ireland with a diverse panel of alternative lenders

We have a wide panel of lenders offering diverse funding solutions for Northern Ireland businesses. What does that mean for your business?

Alternative funders are new challenger banks, private family funds and peer to peer lenders. Their criteria for finding business is different to traditional high street banks. They want a good return for their money and are happy to look at clients who have been trading well that could provide that return. The loan application process is different, and our team will take care of all the paperwork, so the question is, are you ready to improve your access to commercial finance?

Get in touch today to benefit from our expert commercial finance products and alternative credit facilities available. Call our team a call on +447803312874 or request a meeting at a time that suits you.

Sources:

Leave A Comment

You must be logged in to post a comment.