Hire Purchase finance like all methods of commercial financing, has pros and cons. This article carefully considers the advantages and disadvantages of Hire Purchase finance for Northern Ireland businesses in 2022.

Improving Access to Finance in Northern Ireland

Improving access to finance and increasing business knowledge around the diversity of commercial finance products available in Northern Ireland could aid economic recovery. Johnston Financial Solutions are committed to this goal. COVID-19 changed how we live and work globally. During the pandemic, our clients in the manufacturing and technology sectors took decisive action to invest in new equipment and technologies. Hire purchase finance facilitated these investments. It enabled SMEs to quickly buy high spec equipment to accommodate the digital acceleration in consumer behaviour, developments in advanced manufacturing and changing business models, which unfolded rapidly.

The largest firms are innovating to boost productivity growth. This is critical to business growth and sustainability in the evolving digital landscape. However, there is a risk that smaller firms are falling even further behind. Accelerated technology and operational innovation adoption has been particularly pronounced among global “superstar” companies. As the pandemic recedes, this digital acceleration could lead to an uneven economic recovery across Europe (Source McKinsey 2021). This is evident in a growing gulf between the few outperforming companies with solid finance plans and credit structuring and the majority of SMEs and microbusinesses across Northern Ireland.

Strategically leveraging Commercial Finance

Northern Ireland business owners can take decisive action to prevent this gulf of competitive advantage from developing. Strategically leveraging commercial finance and alternative lending, specifically asset financing could be the key. Commercial finance products are available, which can help businesses owners improve their processes and competitive advantage. Upgrading essential equipment, investing in new technologies and advanced machinery is essential to Northern Ireland businesses as we recover. One such option is asset finance through hire purchase.

Advantages of Hire Purchase

Hire Purchase is a simple way of asset financing and typically relatively easy to obtain. With Hire Purchase, a business can benefit from buying high specification equipment, start using it immediately, and repay the purchase price in instalments over several years. Meet with Mark for an illustration on Hire Purchase of equipment

One of the advantages of Hire Purchase financing is that businesses choose a fixed term and deposit amount, reflecting your circumstances and budget. Many companies use Hire Purchase finance for commercial vehicles, plant & machinery, and better equipment because it allows them to spread the cost with fixed repayments and become the asset owner at the end of the term.

Hire purchase finance can help businesses find new ways to innovate and operate more efficiently by improving access to finance. Hire Purchase provides business owners with the means to buy new equipment without draining company cash reserves to make a lump sum payment.

Below are some of the critical advantages of Hire Purchase financing

Positive impact on cashflow

Many Northern Ireland business owners prioritise stabilising their business with a laser-sharp focus on cash flow management and maintaining existing revenue streams. SMEs are even more acutely aware of their cash flow position. Those strategically on maintaining a healthy cash flow will know that having a significant draw on company cash reserves can reduce your ability to bounce back from unexpected challenges in the short term and cause problems in the future.

With hire purchase financing, the business will pay a fixed repayment amount monthly over a set period, making budgeting and financial forecasting much simpler. At the end of the contract, you will usually pay a small fee to secure the asset. Early completion of a Hire Purchase agreement is possible with an appropriate termination fee payment if the business decides to refinance.

Investment in High Spec Equipment

Making a significant investment in high spec equipment is outside the typical operating budgets for most SMEs in Northern Ireland. Hire Purchase can help you upgrade machinery to speed up crucial processes in your business. Hire Purchase is an excellent option for those after machinery finance, with an opportunity to buy the assets after the agreement. A HP agreement for machinery is relatively quick to arrange. With the right help, your business could be making the most of new machinery within days.

Hire Purchase finance has the advantage of lowering the barriers to investment in machinery and equipment for SMEs. And businesses can balance the business benefits of investing in higher-spec tools and equipment against the monthly repayments. A balance of cost savings and new business gained through advanced processes can deliver a competitive advantage and have more financial benefits in the long run. Robert from Central Tanker Services shares his experience in this video.

Lower interest than other funding options

The current economic climate is uncertain, with rising inflation impacting operating costs for business owners. The rise in inflation has put pressure on the Bank’s Monetary Policy Committee (MPC) to take action. The Bank of England has voted to increase the base rate to 0.25% from its record low of 0.10%. This adjustment aims to slow down rising inflation. However, some have concerns that increasing the cost of commercial finance will damage the economic recovery. Interest rates are fixed for the repayment term of a Hire Purchase agreement and often works out lower than an overdraft or bank loan options.

The Super Deduction on Capital Expenditure

For expenditure incurred from 1 April 2021 until the end of March 2023, companies can claim a Super Deduction 130% capital allowances on qualifying plant and machinery investments. Under the super-deduction, for every pound a company invests, their taxes are cut by up to 25p. The super deduction gives businesses investing in qualifying equipment a much higher tax deduction in the tax year of Purchase than would otherwise commonly occur through a ‘first-year allowance (FYA). The allowances apply for capital investments made between 1 April 2021 and 31 March 2023. With a hire purchase arrangement, you can claim this tax relief on the commencement of the hire purchase agreement.

The Annual Investment Allowance

These Super Deduction allowances will be available alongside the ongoing Annual Investment Allowance (AIA), which already gives 100% relief for costs of qualifying plant and machinery in the tax year of Purchase. This allowance applies to plant and machinery used solely for business, including items such as computers, from your business’s profits before tax. The annual investment allowance limit was temporarily increased to £1 million until 31 December 2021. The government has announced that this will now last until March 2023. These changes make the UK’s capital allowance regime more internationally competitive

Ownership of the Asset

Another advantage of hire purchase over lease-based asset finance options is that you own the equipment after the last instalment. The asset’s title will transfer after the final instalment, providing an asset to the business for possible refinancing in the future. Owning the equipment can also make Hire Purchase more tax-efficient depending on what the asset is, how the equipment will be used in your organisation and how it will depreciate on the company balance sheet.

If you are looking at Hire Purchase for machinery or hire equipment with a right to buy at the end of the agreement, call and speak to our experts on +447803312874

Disadvantages of Hire Purchase

Sourcing the proper funding to buy equipment is about reviewing all the options, as every business case is unique, which is why you should speak to an independent credit broker. Johnston Financial Solutions prides itself in finding the best solution for your business. There are several reasons why any finance solution like Hire Purchase may not be suitable for your business, and there are plenty of alternatives that could prove a better fit. Book a Call with Mark Johnston to discuss your unique situation.

Fixed payments over a period of time

Fixed repayments for a Hire Purchase agreement on equipment for a considerable length of time may be a big change within your business. While fixing the cost of an expensive asset is, in most situations, beneficial to a business, you will have to plan for an ongoing commitment to meet the repayments for the term. The duration of most hire purchase schemes can be quite lengthy. Typically, anywhere between 2 to 6 years. As with any asset financing agreement, if the business is unable to keep up the monthly repayments, the lender could be within their rights to seize the asset. However, business owners should not discredit Hire Purchase as a viable option for this reason. All commercial credit facilities will require careful financial planning and management of your cash flow. With consultation, Johnston Financial Solutions can help your business assess the suitability of a Hire Purchase facility.

Alternative asset finance

If the Hire Purchase agreement facilitates the purchase of state-of-the-art equipment that will hold its value, that makes good business sense and then it is a good choice. However, for other equipment purchases, like office equipment or commercial vehicles, you will need to consider if a Leasing facility would be a better fit than Hire Purchase.

Cost of Hire Purchase Financing

Hire Purchase agreements have a fee for arranging the product. As with most credit facilities, one disadvantage of Hire Purchase is that you will pay a higher cost for the same equipment than an outright cash purchase. While this may be factual, it may not disadvantage a business owner. The adage ‘cash is king’ is true for most. For most small businesses in Northern Ireland, cash flow is often a higher priority in the long term for business stability and development. The additional costs of the Hire Purchase facility to spread out payments in a fixed repayment plan is viewed as a necessary expense to protect your cash flow and can be deducted as such.

Asset depreciation

In some circumstances, the asset you have bought may have depreciated to such a degree over the lifetime of the agreement that when ownership of the asset passes to the business, it has no value on the balance sheet and requires replacement. Take advice from your accountant on depreciation and have a chat with Mark to assess if Hire Purchase or Lease Financing would be a better option for your unique case.

How does hire purchase work?

With hire purchase, the company agrees to purchase an asset. Instead of paying the purchase price as one lump sum, an agreement is drawn up to pay the purchase price, plus interest, in equal monthly instalments over a specified term. A deposit is required. A business will pay a deposit of perhaps 10% of the purchase price at the start of the agreement.

In practice, the lender buys the vehicles, machinery or equipment and hires it to the business for a fixed monthly rate over an agreed period. Both parties will decide on the repayment term, typically 3-5 years. The longer the repayment term, the lower the monthly repayments will be. Sometimes, the final repayment is for a more considerable amount, known as a ‘balloon payment’. Whilst fixed rates are most common in Hire Purchase agreements; variable rate options are available.

Throughout the Hire Purchase agreement term, the lender is the legal owner of the asset. Then upon payment of the last instalment, the business becomes the legal owner. Note that the agreement holder is ordinarily responsible for insurance and maintenance of the asset during the repayment term.

How Much Does Hire Purchase Cost?

Assets with higher resale values such as machinery, agricultural equipment, vehicles have more favourable interest rates. Assets which are considered ‘soft’ due to low resale value may not get a good deal. Equipment such as printers, vending machines, and office furniture will be given less favourable rates.

How much are monthly repayments on a Hire Purchase Agreement?

The monthly repayment on a Hire Purchase facility will depend on the individual purchase proposed. Lenders consider the amount borrowed and the length of the repayment term. The value of the deposit placed at the outset of the agreement impacts the deal. The proposal will also detail whether the rates will be fixed or varied and the interest rate charged

Monthly Hire Purchase payments

Hire purchase repayments are monthly. Hp payments are calculated by removing the deposit and agreed lump sum from the equipment costs. The lender acts as the legal owner until the last payment transacts, at which point ownership is transferred over to the business.

Below is an illustration of a Hire Purchase Agreements for the Hire purchase of Farm Machinery, IT equipment and Advanced Manufacturing Equipment

What Assets can be purchased on Hire Purchase?

Businesses can purchase a range of assets using Hire Purchase financing. These include a broad range of machinery and plant. Everything from farm machinery, commercial vehicles, specialist equipment for tradespeople, advanced technology systems, robotics, state of the art printers, and more.

Monthly Hire Purchase Repayment on Farm Machinery

Type of Asset: Farm Machinery

New Holland CX8.90

Value of Machinery: £220 000

Finance Terms in Months: 36

Estimated interest: 4.1 %

Total repayable £247 060

Monthly repayments £6,862.78

*This interest rate is for illustrative purposes only your interest rate may differ. Rates and repayments confirmed during your application. Terms reflective of your unique circumstances

Monthly Repayment on Hire Purchase Agreement for IT Equipment

Type of Asset: IT Equipment

Value of Machinery: £87 000

Finance Terms in Months: 36

Estimated interest: 4.3 %

Total repayable £94 482

Monthly repayments £3936.75

*This interest rate is for illustrative purposes only your interest rate may differ. Rates and repayments confirmed during your application. Terms reflective of your unique circumstances

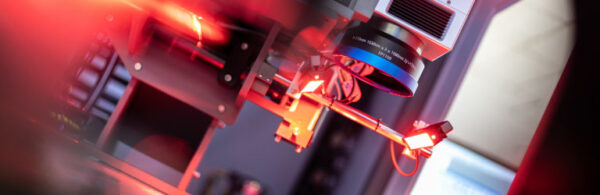

Monthly Repayment on Hire Purchase for Machinery & Plant

Type of Asset: Advanced Manufacturing Machinery

Fibre Laser Technology, Custom Fiber Laser Workstations for Welding, Cutting, Drilling and Cleaning

Value of Machinery: £980 000

Finance Terms in Months: 60

Estimated interest: 3.9%

Total repayable £1,171,100.00

Monthly repayments £19,518.33

*This interest rate is for illustrative purposes only your interest rate may differ. Rates and repayments confirmed during your application. Terms reflective of your unique circumstances

Get A Quote for Hire Purchase Financing

We have a wide panel of lenders offering diverse funding solutions for Northern Ireland businesses. Get in touch today to benefit from our expert knowledge of Hire Purchase products and alternative credit facilities available. Call our team a call on +447803312874 or request a meeting at a time that suits you.

Leave A Comment

You must be logged in to post a comment.