Appetite from lenders for Commercial Mortgage facilities in Northern Ireland is strengthening, enabling significant private investment in Northern Ireland commercial property. The outlook is encouraging as major investors show continued interest in Northern Ireland’s commercial real estate. Some sources differ in their projections, however there is agreement that property investment in Northern Ireland has begun to show resilience.

Investors Return To Acquire Northern Ireland Commercial Real Estate

Investors return to acquire Northern Ireland’s commercial real estate as the economy stabilises with around £300M in transactions expected to be completed for 2021. Investment has bounced back, according to Commercial real estate agency CBRE NI which said the sector had been rejuvenated in 2021 after a quiet 2020 when the Covid-19 pandemic pared back the volume. Whilst Q2 was quieter than expected, the current picture for the Northern Irish investment market for 2021 is optimistic. Volume is on course to exceed 2020’s annual volume during the next quarter and surpass the five-year annual average by the end of the year

Commercial Property Invest in Northern Ireland Post Pandemic

Northern Ireland is still adjusting to the global shifts in the economic landscape impacting commercial property investment post-pandemic. Flexibility in working arrangements has seen an unprecedented change to flexible working with blended models of working from home likely to continue in the future. However, with large firms such as PWC new flagship office space, ASOS new Tech Hub and Agios new hybrid model within the Belfast technology centre at Urban HQ, investment in bricks and mortar workspaces are set to continue.

Firms such as these, announcing large-scale commitments to job creation, bolster investments in office spaces. Development of office spaces continues to account for more than 50% of commercial property investment in Northern Ireland. While such employers continue to support flexible working, many teams and new employees are opting for a blended experience to support learning, innovation, collaboration, career progression and team building. With some reports indicating a 49% increase in take up of office accommodation in Belfast. Prime headline rents in Belfast, at the end of H1 2021, for best-in-class Grade A stood between £21.00 per sq ft and £23.00 per sq ft. Average rents for refurbished properties have been in the region of £18.00 to £20.00 per sq ft.

Transformation on the High Street

Retail has been transformed over the past decade. The soaring levels of e-commerce compounded by changes in consumer behaviour during the pandemic have seen major retailers failing. These changes are affecting occupancy levels in high streets and rental rates across the market. Whilst it has never been more critical to assess the location, tenant and sector associated with property purchase for investment, retail parks continue to show resilience.

The retail sector is the second-largest sector by investment volume in 2021, with commercial real estate consultants seeing a rise in investment in retail parks, which is encouraging. Manchester-based David Samuel Properties recently purchased the Lisnagelvin Retail Park, in Derry-Londonderry for £9.5 m and the Shane Retail Park on Belfast’s Boucher Road for £23m. This takes the property group’s spending in Northern Ireland to more than £81m in the past 24 months.

Overseas Investments is Supported by Local Private Investment

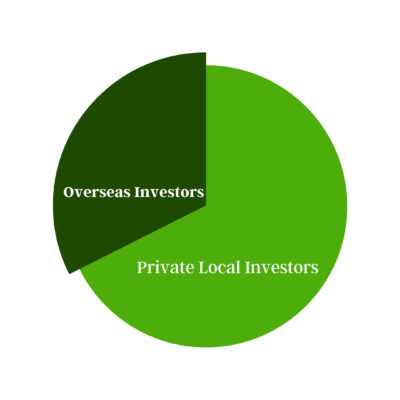

Overseas buyers have also invested, accounting for over half of volume, due in part to the Q1 purchase of Merchant Square, Belfast city centre by a private Middle Eastern investor for £87m. These larger-scale investments are encouraging and indicative that the commercial property available in Northern Ireland is an attractive investment for those wishing to diversify their business investments.

Overseas buyers have also invested, accounting for over half of volume, due in part to the Q1 purchase of Merchant Square, Belfast city centre by a private Middle Eastern investor for £87m. These larger-scale investments are encouraging and indicative that the commercial property available in Northern Ireland is an attractive investment for those wishing to diversify their business investments.

Outside interest in the market here is supported by the welcome return of local private investors, with investors accounting for two-thirds of Q2 volume. Local investors have now completed double the number of deals for the whole of 2020.

Commercial property investment in Northern Ireland is diverse, with large scale investments made through pension syndicates alongside local private property investors. Business owners in Northern Ireland have begun to reinvest.

Contact Johnston Financial Solutions

Johnston Financial Solutions deliver quick, simple and competitive financing options for commercial mortgages to take your business to the Next Level. Get in touch today and arrange a meeting to see if we can help your business access finance for growth or expansion.

What is a Commercial Mortgage?

Commercial mortgages are a term for any loan secured on property that is not your primary residence. Business mortgages are structured as a term mortgage secured against commercial property or semi-commercial property. Commercial Buy to let mortgages are a particular type of high-volume commercial mortgage packaged for a volume market to support the development of a property portfolio.

A commercial mortgage usually lasts from 3 to 30 years. There are no set rates, and this means that every application is reviewed as lenders investigate the risk levels and suitability of applicants. Deposits for a business mortgage can be substantial, but you may be able to find a suitable offer from our panel of lenders with a 70-75% mortgage.

Loan to value (LTV) measures the loan-to-value ratio to calculate how much you are borrowing in relation to how much the property is worth. Johnston Financial Solutions can help you determine the most appropriate loan to value ratio (LTV) based on an assessment of affordability. If it is an investment property, then the amount you can borrow will be determined by the rental income generated by the investment. LTV typically will not exceed 65% of the purchase price of the asset.

Business benefits associated with a Commercial Property Investment

There are many commercial reasons your business might want to consider taking out a commercial mortgage. Here are a few to consider:

- A commercial mortgage is often used to buy premises for an existing business, providing added stability to an organisation.

- As a commercial property owner, you will ultimately have control over any changes to your business premises.

- The interest on commercial mortgages is tax-deductible.

- Substantial capital gains can be realised with the purchase of a commercial property.

- Property is often considered a sound investment as property values tend to increase over time.

- Investing in commercial property can help you diversify and may reduce business risk.

- Commercial property can generate additional rental income from an office or retail space.

- Solid retirement planning. Holding commercial property investment in a pension fund has long been a favourite investment strategy of business owners.

When considering commercial property investment it is important to note that individual circumstances differ. Best practice recommends that you should obtain specialist guidance from a Financial Adviser when considering any significant investment.

Find out more

Find out more

To find out more about arranging a credit facility to buy a business premises, an investment property or buying land, please get in touch. We can arrange a FREE consultation to discuss how a commercial mortgage can help you and your business—Book A Meeting with Mark.

Client Testimonial: ‘It was daunting to be borrowing such a large amount of money for the first time, and having Mark on board as an independent finance broker reassured us that the business could afford the loan. The management team is happy to recommend Johnston Financial Solutions.’ Angela Mc Donald Moving On Up Limavady

How to apply for a commercial mortgage

Engaging with a specialist independent broker like Johnston Financial Solutions will take the stress out of the application process. Our lead broker Mark Johnston will ensure you have all the information available to you so that you can choose the most suitable lender. Our clients have recommended us because we make the application process more manageable.

How long does the application take to get an offer for a Commercial Property Loan?

Once we have received your enquiry and any required documents, we will typically get our clients an indicative quote within 48hours. The commercial loan will generally complete 6 to 8 weeks later.

Six Simple Steps to Applying for Commercial Mortgage

- Complete and submit the Asset and Liability information

- Complete the Commercial Mortgage Application Form with our guidance

- Provide relevant information on your business (see our checklist below)

- Once approved you will receive a mortgage offer from you chosen lender

- The Commercial Property is valued

- The lender’s solicitors will carry out all legal processes and due diligence

What do I need to support my application for a Commercial Mortgage?

We recommend that you collate the following documents ahead of time in support of your application. Preparing these documents will allow you to move quickly on new property investment and help ensure your application is processed efficiently:

- Bank statements for the last six months

- Three Years Business Accounts

- Statement of Assets Liabilities, Income and Expenditure

- Schedule of Existing Property Portfolio

- Proof of identity and address

- Lease and tenancy agreements

What else should you consider before you choose a mortgage product?

Commercial Property investment is not without its risks. As with every investment, valuations of commercial property can go up as well as down. Commercial property value is influenced by many factors, particularly the supply and demand of property and general economic stability.

How can we help?

Our consultation service will help you carefully consider which mortgage product is best for you and your business. In addition to the documents above, you may have to provide a business plan or financial projections. Affordability is a crucial factor and preparing financial projections will help ensure you can afford the monthly payments. A Business plan could help the lender determine how likely you are to be able to pay off the loan. Johnston Financial Solutions can help you create a Business Plan in support of your application.

Commercial Mortgages and Personal Guarantees

Personal guarantees refer to an individual’s legal commitment to repay a credit facility issued to a business for which they are a director. Providing a personal guarantee means that if the business becomes unable to repay the mortgage, the individual assumes personal responsibility for the balance. Personal guarantees provide an extra level of protection to lenders and are requested in almost all cases for SME limited companies.

Types of commercial mortgages

Mortgage loans are either:

- Owner-occupier mortgages- Buy a property as trading premises for your business.

- Commercial investment mortgages-Investment property Buy-to-let.

What about the interest on a commercial mortgage?

Most commercial mortgages are paid at a variable rate. Typically, a rate will be quoted as X% over base or LIBOR. As an example, Residential Tracker Mortgages have a similar structure. Fixed-rate mortgages are available in some circumstances. The interest rates charged for commercial property and business loans are not determined from the offset like most personal loans. Lenders determine a risk profile that they are comfortable with, so if your loan falls inside their risk profile, it will typically be approved.

What fees are involved?

Arrangement fees: Arrangement fees are payable, added to the loan after approval. Some lenders may request the arrangement fees earlier to cover their work if you do not accept their offer. Arrangement fees are usually 1% -2% of the loan amount for loans up to £1 million.

Survey Fees: A survey is rarely required but may be recommended. An Acquisition Surveyor will charge a fee of between 0.5 % to 3 % of the total cost of purchase for a pre-acquisition survey. There is likely to be a degree of negotiation on this fee. This will depend upon the complexity and skills required to complete the acquisition.

Valuation Fees: The valuer will assess the commercial property’s value and draft a report to the lender. Commercial valuations fees are based on an individual quotation. These are payable to the bank after an initial indicative offer has been approved.

Legal Fees: You’ll need to pay both your legal fees as well as the lender’s, which can start at around £500 for each party.

Broker Fees: Each Broker will have their own fee structure, but you can expect the overall cost to be between 1% and 3% of the loan facility depending on the scenario.

Eligibility and criteria for a Commercial Mortgage

For you to qualify for a commercial mortgage, you will need to pass the lender’s eligibility checks which usually includes:

- A stable cash flow projection

- Review of existing business debts

- Deposit available from 20% to 40% of the loan

- Projected rental income may also be considered

What are the additional costs involved in a commercial property transaction?

In addition to the cost of purchasing a commercial property, there are professional fees and associated transactional expenses. You may need to budget for:

- Professional fees associated with the property transaction, such as solicitor fees, estate agents’ fees, surveyor, and property valuation

- Commercial Finance brokerage fees may apply to the mortgage. You may also choose to engage with your financial adviser before proceeding with the investment.

- If your property is held within a pension fund, you will incur pension trustee administration costs.

- Tax may be payable on the purchase of Land and Buildings depending on the cost of the property.

Johnston Financial Solutions is a Commercial Finance Broker and does not offer advice. Specialist advice should be sought on property valuations, legal matters, investment advice, pension advice, and tax when required.

Talk to Us About a Commercial Mortgage

With our independent expert guidance finding commercial funding has never been simpler.

We like to talk to our clients to get to know you and your business. We get a clear picture of what you would like to achieve with a Commercial Property loan. Then we can:

- Collate the necessary information and documents to prepare an indicative quote.

- Consult with you to review offers from our panel of lenders to be confident that you can choose the best for you.

- Choose a mortgage product from the lender, then valuations are conducted, formal offers made, and funds are drawn down.

Alternatives to a commercial mortgage product

There are several alternative options that we can discuss to assess what the best solution is for your business. If you decide that a commercial mortgage is not the right choice for you we can discuss:

- Bridging Loans

- Unsecured Finance

- Overdraft

- Short-term loans

Useful references

Leave A Comment

You must be logged in to post a comment.